Receiving paychecks quickly, automatically and digitally is important to employees. Employers need to ensure they have that option available for new hires, as well as a method to collect all the necessary information from employees in a direct deposit authorization form upon hire.

Direct deposit authorization forms authorize employers to send money directly into an individual’s bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves. With today’s technology and an employee’s official permission, employers can send out paychecks digitally by directly depositing due money into an employee’s checking or savings account.

The employer provides the form to the employee to fill out usually upon hire (since the option for direct deposit is an expectation of employees these days). The form is where the employee gives you permission for direct deposit and provides the bank information that you’ll need to send them money. This form can be sent straight to the employee digitally with HR software like Eddy.

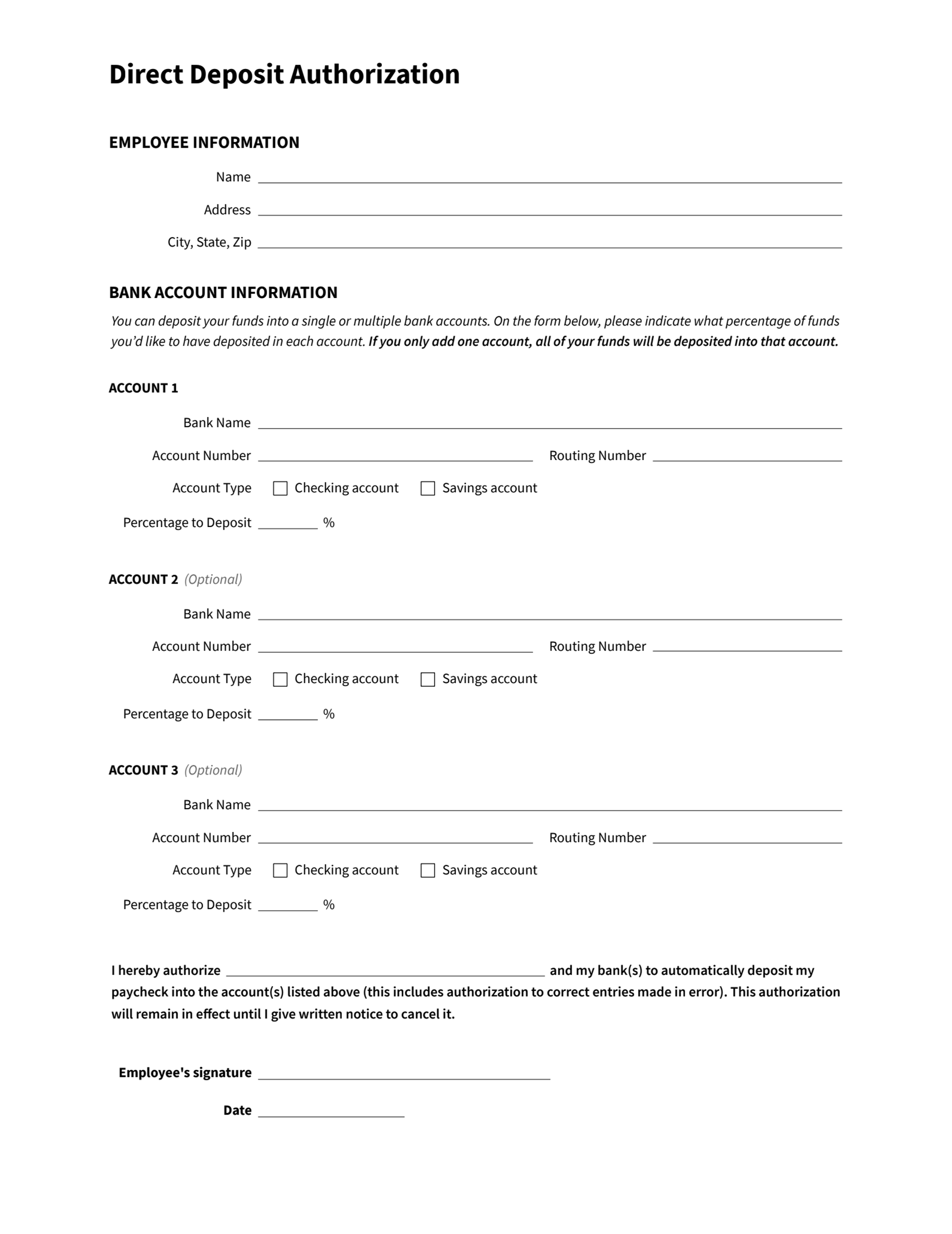

Most people want 100% of their paychecks deposited into a single bank account, but you should give your employees the option to divide their paychecks among multiple accounts or banks. You can do this by having additional sections on the form for each bank/account, along with areas for employees to designate a percentage or specific amount they want sent there.

For additional verification, you can also ask your employees to include a voided check with their completed form. This isn’t required, but it can be helpful if you want further confirmation that the bank name and routing number they provide are accurate.

Once filled out and signed, you can use the information to begin sending money directly into the employee’s checking or savings account(s). This authorization form is critical for organizations to utilize the efficiency of direct deposit, as well as to stay legally compliant in their payroll.

Handling employee bank information without the proper authorization is an easy way to get into deep trouble. Once filled out by the employee, their information should be kept highly confidential by the company’s HR department.

It’s important you include all the necessary fields in your direct deposit authorization form. You don’t want to make your payroll administrators have to track down new employees for information that your form neglected to acquire. You also don’t want to get into any legal trouble.

Listing the company name, address, and contact information can be affirming for employees and will help them know where to go if they have immediate questions.

This is where employees will put down the information you’ll need to know which bank you’re sending money to, which account the money will be deposited in, and exactly how much. It’s good to give your employees the option of splitting up their paycheck among three different accounts. Each account in their own section needs to include:

To make things easier for your employees, consider placing helpful instructions throughout the form. In this section, help them understand they can either put 100% of their paycheck into one account, or they can split it up among multiple accounts and banks.

Include a paragraph sharing all the information and permissions that the employee is signing for. Foremost, it should state that by signing, the employee is authorizing the employer to directly deposit their pay into their listed bank account(s). It’s also a good idea to include timeframes, permissions for the company to make corrections, and other affirmations to decrease company liability.

Below the authorization statement have a space for the employee to sign their name as well as write the date. This is very important to include.

If you want to verify bank information by asking for a voided check, you may include some empty space with a note saying something like “Attach Voided Check Here.”

Here is a direct deposit authorization form template you may implement in your organization. Feel free to throw your company’s name and logo on it.

If you have a business bank account, you could see if that bank offers direct deposit services. The other option would be to pay for a third party payroll/HR service or software (which is what most companies do). There are many different payroll softwares for businesses of all sizes. Finding one that’s right for your company shouldn’t be too difficult. Ask business colleagues for recommendations, or conduct some research online.

Whether you’ve decided on your bank or a third party, you will have to spend some time negotiating prices, watching demonstrations, providing business and financial information, and signing agreements. Communicate with your payroll service group about the details of setup and implementation.

Usually, direct deposit authorization forms are signed by employees soon after they are hired. If you’re setting up a direct deposit service for the first time, you’ll have to ask all of your current employees who want direct deposit to sign a form. Once you’ve collected everyone’s account and routing numbers, account types, banks names, signatures, etc. (see above section), you’ll input this information into your new payroll system. Some payroll systems give employees their own logins, which usually means that they can enter this information into the system themselves. Again, familiarize yourself with the system you choose so you set everything up correctly and efficiently.

Ensure that you have a consistent pay schedule for your employees, including cutoff days/times for employees to submit hours. Coordinate with whomever is administering the payroll system and make sure they have enough time to review and process payroll each pay period. Your payroll provider may have their own cutoff dates for when information needs to be submitted in order for the direct deposit to run.

Once everything is set up, verified and scheduled out, you’re good to get started. Each time you submit company hours into the payroll system, your employees should see their paychecks deposited into their designated accounts within a few days.